View Top-rated Medicare policies in Wake Forest, North Carolina.

Finding the right Medicare Advantage policy can be overwhelming, but with our help, the process will be seamless and simple. Our experts are here to assist you in navigating the complex world of Medicare policies and selecting the best policy to match your personal circumstance. With years of experience in the industry and partnerships with top-rated Medicare companies, you can trust us to handle your Medicare needs with care.

The cost of Medicare Advantage policies in Wake Forest varies based on various factors related to your healthcare needs. These factors include your age, health status, and the level of coverage you require. We understand that every individual has unique healthcare needs, which is why we offer a variety of policy options to choose from.

When you opt for Medicare Advantage Center over other providers, you can expect an exceptional experience. Our user-friendly policy comparison tool allows you to easily view and compare policies in your city at budget-friendly prices, 24/7/365.

Medicare Advantage Center is the leading provider of Medicare policies in North Carolina for a reason. If you’re looking for a Medicare policy in Wake Forest, you have multiple options to choose from. However, it’s important to select a seasoned Medicare team that prioritizes your health over financial gain.

seeking cost-effective Medicare services in North Carolina that prioritize your health and quality?

Regardless of your Medicare needs, Medicare Advantage Center strives to excel in delivering exceptional care, affordability, and customer support, setting us apart from others in the industry.

If you require dependable Medicare services whether it be in the near future or at a later date, visit our quote page to get a personalized quote matched to your Medicare and supplement needs.

Additional Medicare Info in North Carolina

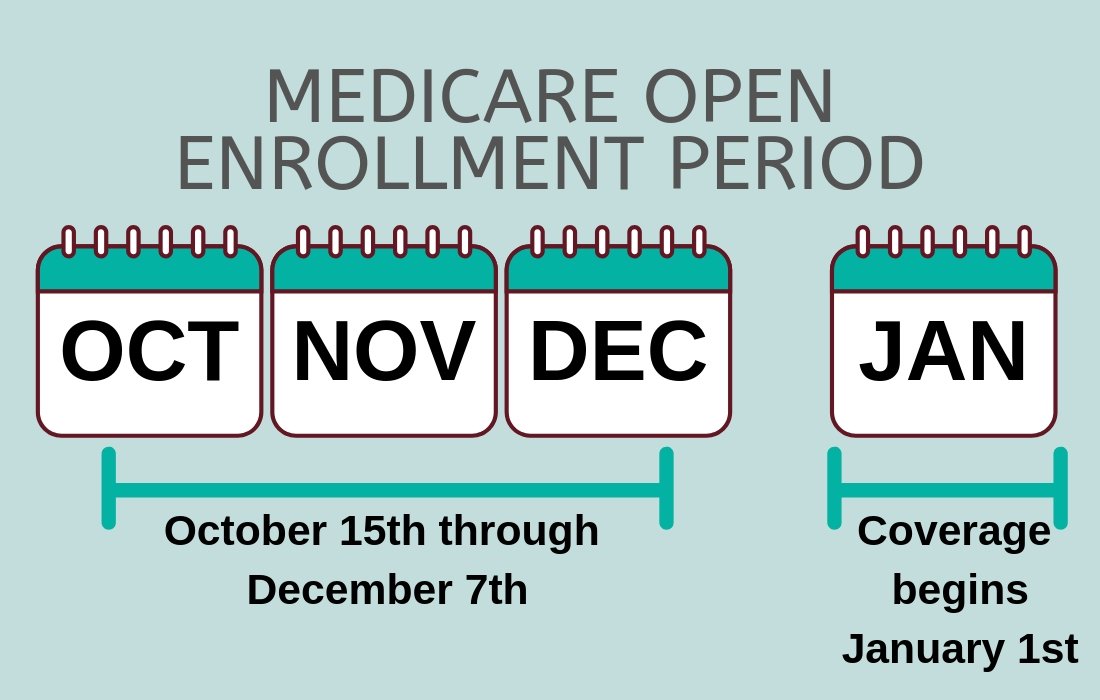

Medicare Plans in Wake Forest, North Carolina: Comprehensive Coverage for Your Health Needs Why Choose Med Health Advisors for Your Medicare Plan in Wake Forest? At Med Health Advisors, we understand the importance of finding the right Medicare plan that meets your unique healthcare needs. As a leading provider of Medicare plans in Wake Forest, North Carolina, we are committed to delivering exceptional care, affordability, and customer support. Here’s why you should choose us: 1. Extensive Coverage Options: We offer a wide range of Medicare plans, including prescription coverage, dental, and vision care. Our comprehensive coverage options ensure that you have access to the healthcare services you need. 2. Affordable Premiums: We understand that cost is an important factor when choosing a Medicare plan. That’s why we offer affordable premiums and deductibles, including $0 premium options, to make healthcare more accessible for you. 3. Expert Guidance: Our team of experienced Medicare advisors is here to assist you in navigating the complex world of Medicare policies. We will help you understand the different plan structures and benefits, ensuring that you make an informed decision. 4. Top-Rated Medicare Companies: We have partnered with top-rated Medicare companies to provide you with the best policy options in Wake Forest. Our partnerships ensure that you receive quality healthcare services from trusted providers. Our Services for Wake Forest Residents At Med Health Advisors, we offer a range of services to cater to the healthcare needs of Wake Forest residents. Our services include: 1. Medicare Plan Comparison: We provide a user-friendly policy comparison tool that allows you to easily view and compare Medicare plans in Wake Forest. Our tool provides detailed information on coverage, premiums, and benefits, helping you make an informed decision. 2. Personalized Solutions: We understand that every individual has unique healthcare needs. Our team of compassionate and friendly advisors takes the time to listen to your concerns and provide personalized solutions that work for you. 3. Additional Benefits: We offer a thorough analysis of your healthcare needs to determine if you qualify for additional benefits. Our goal is to ensure that you receive the maximum benefits from your Medicare plan. 4. No-Cost Plan Comparison: We provide a no-cost plan comparison service to help you find the best Medicare plan that suits your needs and budget. Our experts will guide you through the process, making it seamless and simple. Why You Should Call Med Health Advisors There are several reasons why you may need to call Med Health Advisors for your Medicare plan in Wake Forest: 1. Expert Advice: Our team of knowledgeable advisors is available to answer any questions you may have about Medicare plans. We provide expert advice and guidance to help you make the right decision for your healthcare needs. 2. Enrollment Assistance: We can assist you with the enrollment process, ensuring that you meet all the necessary requirements and deadlines. Our team will guide you through the paperwork and make the process hassle-free. 3. Claims Assistance: If you encounter any issues with your Medicare claims, our team is here to help. We can assist you in resolving claim disputes and ensure that you receive the benefits you are entitled to. 4. Ongoing Support: Our commitment to your healthcare doesn’t end after enrollment. We provide ongoing support and assistance throughout the duration of your Medicare plan, ensuring that you have a trusted partner by your side. Take Action Today: Request a Quote or Call Us Don’t wait to secure the right Medicare plan for your healthcare needs. Take action today by requesting a quote or calling us for assistance. Our team of experts is ready to help you find the best Medicare plan in Wake Forest, North Carolina.