View Top-rated Medicare policies in Central Islip, New York.

Finding the right Medicare Advantage policy can be overwhelming, but with our help, the process will be seamless and simple. Our experts are here to assist you in navigating the complex world of Medicare policies and selecting the best policy to match your personal circumstance. With years of experience in the industry and partnerships with top-rated Medicare companies, you can trust us to handle your Medicare needs with care.

The cost of Medicare Advantage policies in Central Islip varies based on various factors related to your healthcare needs. These factors include your age, health status, and the level of coverage you require. We understand that every individual has unique healthcare needs, which is why we offer a variety of policy options to choose from.

When you opt for Medicare Advantage Center over other providers, you can expect an exceptional experience. Our user-friendly policy comparison tool allows you to easily view and compare policies in your city at budget-friendly prices, 24/7/365.

Medicare Advantage Center is the leading provider of Medicare policies in New York for a reason. If you’re looking for a Medicare policy in Central Islip, you have multiple options to choose from. However, it’s important to select a seasoned Medicare team that prioritizes your health over financial gain.

seeking cost-effective Medicare services in New York that prioritize your health and quality?

Regardless of your Medicare needs, Medicare Advantage Center strives to excel in delivering exceptional care, affordability, and customer support, setting us apart from others in the industry.

If you require dependable Medicare services whether it be in the near future or at a later date, visit our quote page to get a personalized quote matched to your Medicare and supplement needs.

Additional Medicare Info in New York

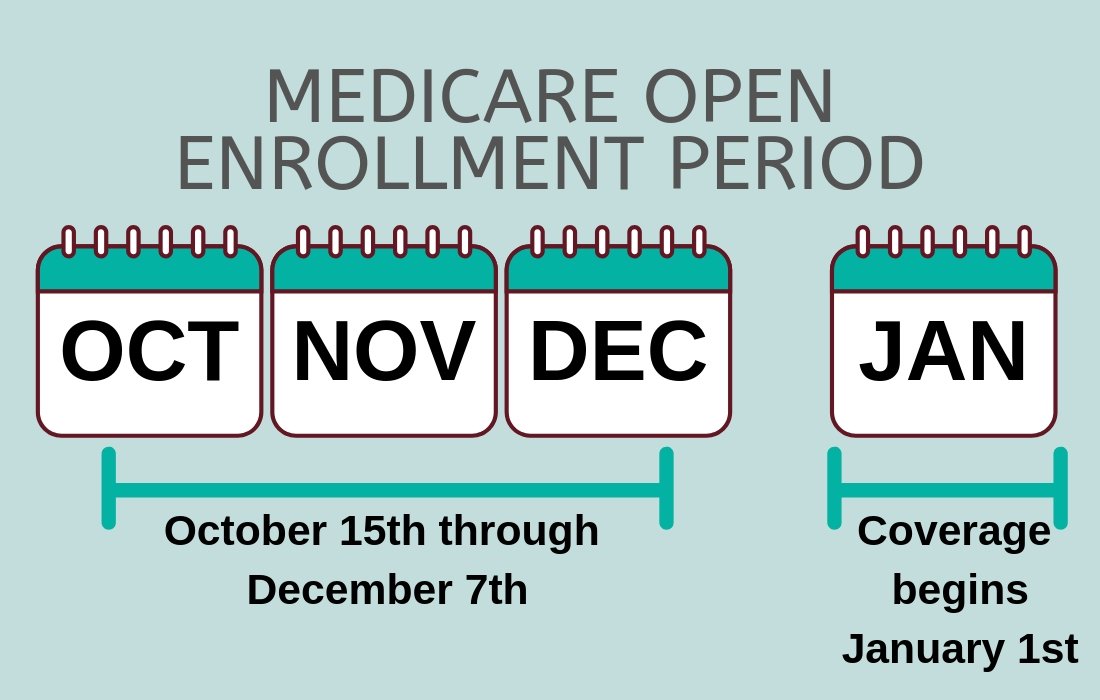

Medicare Advantage Plans in Central Islip, New York: Providing Comprehensive Healthcare Coverage Why Choose Med Health Advisors for Your Medicare Needs in Central Islip? When it comes to finding the best Medicare Advantage plans in Central Islip, New York, Med Health Advisors stands out as a trusted and reliable partner. With our extensive experience in the industry and a team of highly competent professionals, we are dedicated to providing comprehensive healthcare coverage that meets the unique needs of individuals in Central Islip. Expertise in Medicare Plans At Med Health Advisors, we specialize in offering a wide range of Medicare plans, including those that cover prescription medications, dental care, and vision services. Our team of experts has in-depth knowledge of the various plan options available in Central Islip, ensuring that you receive the most suitable coverage for your specific healthcare needs. Personalized Solutions We understand that every individual has unique healthcare requirements. That’s why we take the time to listen to your concerns and provide personalized solutions that work for you. Our goal is to ensure that you have access to the best Medicare Advantage plans in Central Islip that align with your budget and healthcare needs. Seamless Enrollment Process Navigating the complex world of Medicare policies can be overwhelming, but with Med Health Advisors, the process is seamless and simple. Our team of experts is here to assist you in finding the right Medicare Advantage plan that matches your personal circumstances. We have partnerships with top-rated Medicare companies, giving you peace of mind that you are in good hands. Comprehensive Medicare Advantage Plans in Central Islip When it comes to Medicare Advantage plans, Central Islip residents have a variety of options to choose from. Whether you prefer an HMO, PPO, PFFS, or SNP plan, Med Health Advisors can help you find the perfect fit for your healthcare needs. HMOs: Affordable and Coordinated Care HMO plans are a popular choice among Central Islip residents who value affordable and coordinated care. With an HMO plan, you must receive all services from in-network providers, designate a primary care physician (PCP), and obtain referrals for specialist care and some prescriptions. These plans often include prescription drug coverage, making them a comprehensive choice for many individuals. PPOs: Flexibility and Choice For those who prioritize flexibility and choice, PPO plans may be the ideal option. With a PPO plan, you have the freedom to choose any healthcare provider or facility, both in-network and out-of-network, without the need for a PCP or referrals for specialists. While PPO plans typically include prescription drug coverage, standalone drug coverage is not available. It’s important to note that PPO plans may have higher out-of-pocket costs and premiums compared to other plan types. PFFS Plans: Freedom to Choose Providers PFFS plans offer the freedom to choose any Medicare-approved healthcare provider or facility that accepts the plan’s payment terms. These plans do not require a PCP or referrals for specialists. Depending on the plan, prescription drug coverage may be included, or you can opt for standalone drug coverage. It’s important to consider that choosing a provider who doesn’t agree to the plan’s terms may result in higher costs. SNPs: Tailored Care for Specific Needs SNP plans are designed to provide tailored care for individuals with specific conditions and characteristics. These plans include care coordination and targeted benefits that meet your unique healthcare needs. With an SNP plan, you need a PCP and referrals to specialists. Prescription drug coverage is always included, and if you’re eligible, you can join an SNP at any time. When to Enroll in Medicare Advantage Plans in Central Islip To qualify for enrollment in a Medicare Advantage plan, you must first be enrolled in both Medicare Part A and Part B and cannot have an existing Medigap plan. In Central Islip, there are three periods when you can enroll: 1. Initial Coverage Election Period: This period includes the three months before your 65th birthday, the month of your birthday, and the three months following. If you have a disability, this period will occur three months before or after your 25th month of receiving benefits. 2. Annual Election Period: Running from October 15 to December 7, this period allows you to switch from Original Medicare to a Medicare Advantage plan. If you’re already enrolled in Medicare Advantage, you can switch between plans during this period. 3. Open Enrollment Period: Taking place between January 1 and March 31, this period allows you to switch between Medicare Advantage plans or go back to Original Medicare. Contact Med Health Advisors Today If you’re looking for the best Medicare Advantage plans in Central Islip, New York, Med Health Advisors is here to help. Our team of compassionate and friendly professionals is dedicated to providing exceptional care, affordability, and customer support. We prioritize your health and quality of life, ensuring that you receive the comprehensive coverage you deserve. Call us today for a quote or to schedule a consultation with one of our experts. Take the first step towards securing your healthcare future with Med Health Advisors.